Blog

New GST Rates List (Effective September 22, 2025)

Advertisement

Advertisement

Check Our Youtube For Detailed Videos: Click Here

GST, or Goods and Services Tax, is a part of nearly everything we purchase or use — from daily groceries to monthly mobile bills. It directly impacts our expenses. In September 2025, the Government of India rolled out a major reform called the Next-Gen GST. This new GST rate structure is designed to ease the burden on the common man by lowering tax rates while simplifying the system for both consumers and businesses.

0% GST (Nil Rate – Essentials)

No GST applied on basic needs, education, and certain healthcare.

| Category | Items Included |

| Dairy & Food | UHT milk, chhena (paneer), roti, khakhra, pizza bread |

| Education | Educational erasers |

| Insurance | Life, health, and general insurance |

| Medicines | Specified life-saving drugs |

5% GST (Daily Use & Merit Goods)

Advertisement

Affordable slab for household essentials, small goods, and budget services.

| Category | Items Included |

| Food & Beverages | Milk products, nuts, chocolates, biscuits, confectionery, sugar-based items, soya/plant-based milk, sauces, soups |

| Household & Utensils | Basic utensils, bamboo furniture, handicrafts, wooden/ceramic/metalware |

| Stationery & Personal Care | Stationery items, toiletries |

| Clothing & Footwear | Shoes under ₹2,500 |

| Entertainment & Fitness | Musical instruments, toys, small appliances, gym & yoga services |

| Hospitality & Travel | Hotel rooms up to ₹7,500 per night, cinema tickets under ₹100 |

| Others | Labeled “merit goods” in food/drink category |

18% GST (Standard Rate – General & Consumer Goods)

Most consumer goods, services, and vehicles fall under this bracket.

| Category | Items Included |

| Electronics & Appliances | TVs, ACs, washing machines, refrigerators, other large appliances |

| Vehicles | Small cars, motorcycles up to 350cc, buses, three-wheelers |

| Construction | Cement, coal |

| Auto Parts | Auto components & spare parts |

| Premium Consumer Goods | SUVs, bigger vehicles, and other premium categories |

40% GST (Sin & Luxury Goods)

Highest slab for luxury and non-essential/sin goods.

| Category | Items Included |

| Tobacco & Related Products | Cigars, cigarettes, gutkha, bidis |

| Luxury Beverages | Carbonated & caffeinated drinks |

| Luxury Vehicles & Travel | Luxury cars, private jets, helicopters, yachts |

| Leisure & Gambling | Casinos and related services |

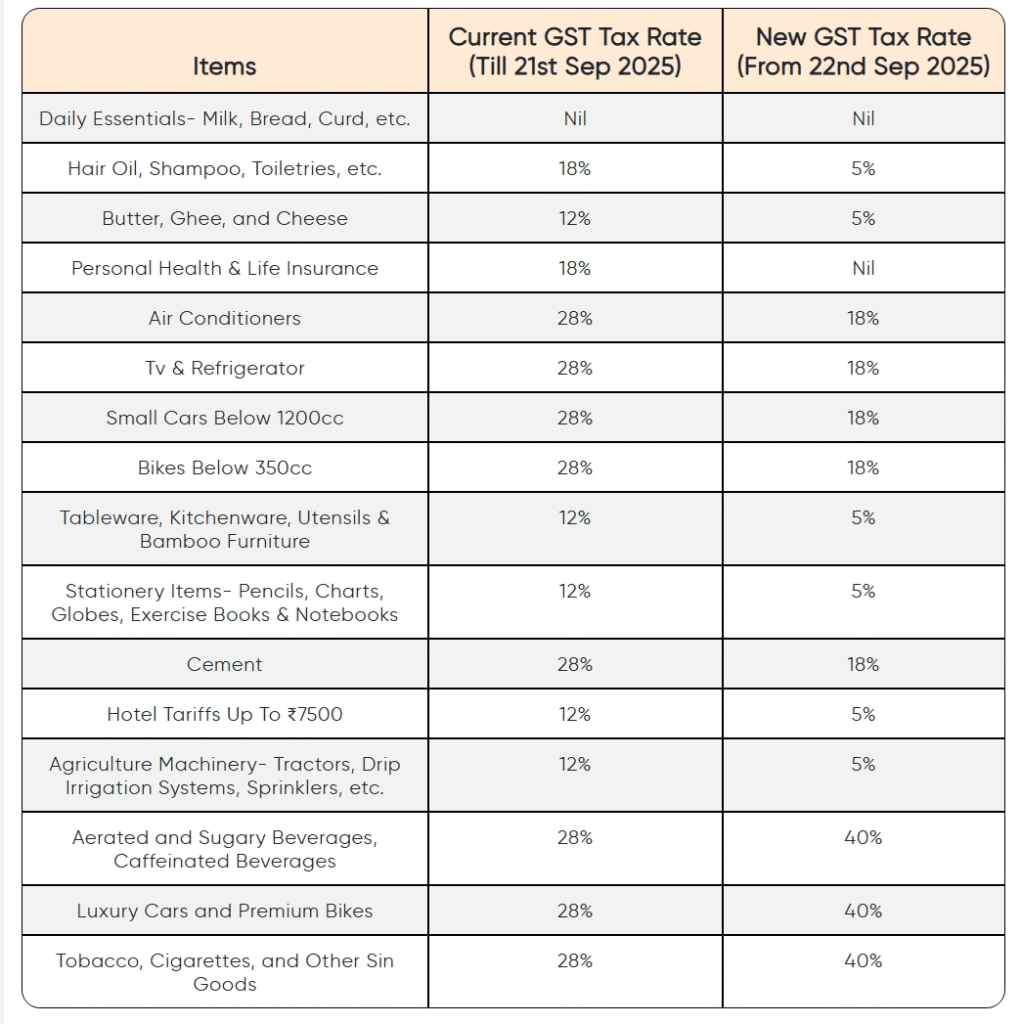

Comparison

Summary of GST Reform (2025)

- Old Slabs (5%, 12%, 18%, 28%) → New Simplified Slabs (0%, 5%, 18%, 40%)

- Essentials made tax-free to provide relief to the middle class.

- Everyday goods moved to 5% GST for affordability.

- Most other goods/services standardized at 18% GST.

- 40% GST continues as a deterrent on luxury & sin goods.